How big is the impact of China's export control of gallium and germanium on display screens?

China's Ministry of Commerce and other departments said on the 3rd that from August 1 to implement export controls on gallium, germanium related items. The statement said the move was to safeguard national security and interests.

Gallium, known as the "backbone of the electronics industry", is widely used in the semiconductor industry and the solar cell industry, and demand is increasing. Gallium metal can be used in gas sensors, solar cells, rare earth permanent magnet materials, and compound semiconductors such as gallium arsenide and gallium nitride.

Germanium is an excellent natural semiconductor, widely used in semiconductor, optical fiber communication, infrared optics, solar cells, chemical catalysts, biomedicine and other fields.

China is rich in gallium and germanium resources. "Science in China" statistics show that China's gallium reserves are about 190,000 tons, accounting for about 80% of global gallium reserves, ranking first in the world, usually associated with lead and zinc minerals. China is also the world's largest germanium producer and exporter, and the world's proven germanium reserves are only 8,600 tons, the United States and China have 45% and 41% respectively. Germanium is difficult to be formed independently, and germanium resources in China mainly come from "lead-zinc type" and "coal-type" germanium deposits.

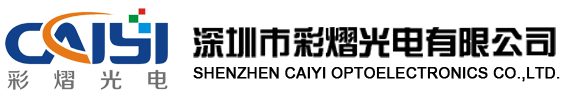

In the transition from the stable gallium arsenide (GaAs) market to the dynamic indium phosphide (InP) market, can fierce competition determine the dominance of these two technologies? Yole, an analyst firm, did a study.

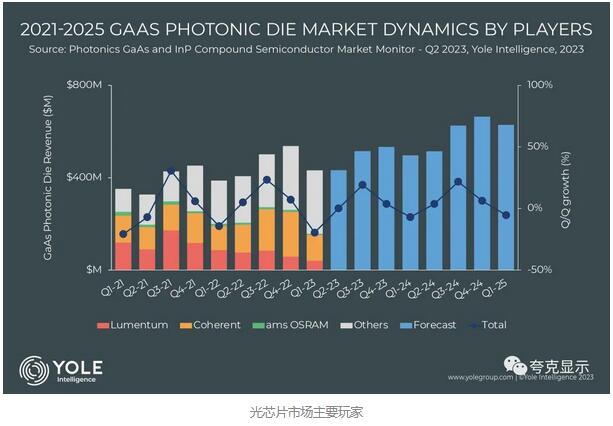

Indium phosphide (InP) market size is expected to grow from $3 billion in 2022 to $6.4 billion in 2028.

In the first quarter of 2023, the growth rate of the data communications and telecommunications market slowed significantly, mainly due to the overinventory of optical transceivers and weak demand for hyperscale data centers and cloud service providers.

In addressing these challenges, indium phosphide device manufacturers and substrate suppliers are facing issues such as declining order volumes and negative growth rates.

In consumer applications, gallium arsenide (GaAs) technology is expected to recover and outperform indium phosphide in terms of compactness, integration, and cost.

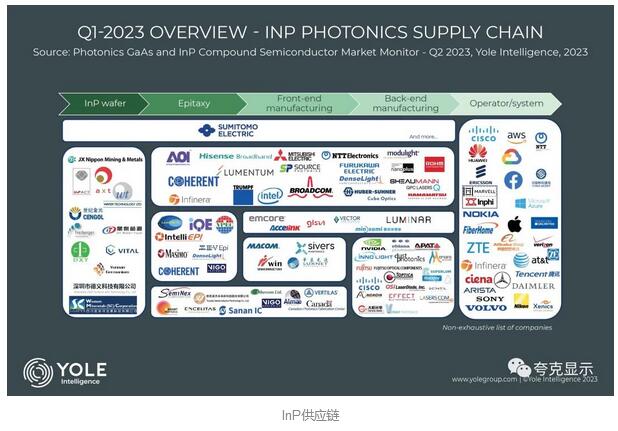

According to research by Yole Intelligence, part of the Yole Group, data in the photonics Gallium arsenide (GaAs) and indium phosphide (InP) composite semiconductor market Monitor report has long been driven by data communication applications. The VCSEL for 3D sensing becomes the largest application since Apple adopted gallium arsenide photonics in the iPhone X in 2017.

In 2022, the total gallium arsenide chip market reached $18.3 billion and is expected to double by 2028. To enable cost-effective mass production, manufacturers now use 6-inch diameter gallium arsenide wafer platforms.

The competition between the two business models of gallium arsenide photonics has directly reshaped the supply chain.

Lumentum, a key supplier to Apple, has had partnerships with epitaxial material plants and fountainhouses for years, while Coherent (previously known as II-VI) has pursued vertical integration through acquisitions. Recently, a new company entered the 3D sensing ecosystem for smartphone makers. In the epitaxial film market, the British IQE company has a dominant position as the main supplier. What will the competition between the major players look like? In the future, how will the return of Android smartphone manufacturers change the gallium arsenide photonics market?

The main market driver for Indium phosphide (InP) continues to be data communications and telecommunications, due to the unique ability of InP photonic devices to achieve high bandwidth, high data rates and long transmission distances in optical transceivers.

The indium phosphide market size is expected to grow from $3 billion in 2022 to $6.4 billion in 2028. It has been observed that well-known consumer goods manufacturers have adopted indium phosphide technology in wearable headsets and smartphones to implement proximity sensors. It is worth noting that Apple, which is known for its innovation in the mobile phone industry, has redesigned the "bangs" of the iPhone 14 Pro series into a "pill" shape and integrated certain sensors below the OLED screen. This transition involves replacing the gallium arsenide VCSEL with an indium phosphide Edge Emitting Lasers (EEL).

It has been observed that well-known consumer goods manufacturers have adopted indium phosphide technology in wearable headsets and smartphones to implement proximity sensors. It is worth noting that Apple, which is known for its innovation in the mobile phone industry, has redesigned the "bangs" of the iPhone 14 Pro series into a "pill" shape and integrated certain sensors below the OLED screen. This transition involves replacing the gallium arsenide VCSEL with an indium phosphide Edge Emitting Lasers (EEL).

Such a shift opens up opportunities for major gallium arsenide players to enter the indium phosphide market, as both materials can use the same processing tools.

來(lái)源:集微網(wǎng)